LEGACY UNDER OAK CO.

At Legacy Under Oak Co., I work with ambitious individuals ready to move beyond money management and into wealth mastery.

Whether your next step is scaling your business, structuring investments, or securing generational legacy I help you move with precision, clarity, and control.

Mission: To help high achieving individuals master wealth through mindset, discipline, and financial strategy.

Vision: To see every client move from financial confidence to financial command creating wealth that not only lasts, but leads.

Core Values O.A.K.

Ownership: You are the architect of your wealth. Every decision, every dollar, every direction is led by intention.

Advancement: Growth is the standard. I position your capital, business, and mindset to evolve beyond comfort and into mastery.

Keystone: Discipline and structure are the foundation of wealth. They hold every part of your financial strategy together.

COURTNEY S. JENKINS

With a foundation in business management, years of financial experience, and a proven framework for turning capital into strategic growth, I help clients make confident financial decisions, scale their businesses, and build lasting impact.

My journey started in real estate. First through wholesaling, then as a licensed realtor, and eventually as the founder of my own real estate company. I managed residential and commercial portfolios, overseeing multimillion-dollar budgets and operations. That hands-on work taught me how wealth is truly built, structured, and scaled.

I’ve been through the uncertainty, the rebuilding, and the strategic refinement myself. Over time, I developed systems that maximize savings, investments, and income-producing assets. That lived experience, combined with mindset and strategy, is what I bring to every client: a pathway to wealth that aligns with their values, vision, and long term goals.

During this period, I also wrote my first self-help book, which deepened my passion for personal growth and opened the door to coaching. I began with personal development work, which naturally evolved into financial coaching helping people build strategy around budgeting, saving, debt reduction, investing, and business.

Alongside coaching, I host the Legacy Under Oak Podcast, where I share honest conversations about wealth, mindset, culture, and what it truly means to build a legacy.

At Legacy Under Oak Co., this work isn’t about quick wins or generic advice. It’s about intentional growth, disciplined strategy, and high level results. I work with clients who are ready to take control, move with purpose, and elevate their financial lives.

THE OAK VAULT

I’ve lived the principles I teach. From investing to running multiple businesses, I understand what it takes to turn vision into financial freedom and I guide you to do the same with strategy and intention.

Legacy Under Oak is where wealth, strategy, and culture meet. This podcast helps individuals make confident financial decisions, build generational wealth, and heal from money trauma all while honoring the cultural roots that shaped them.

Tune in Here

Spotify

https://open.spotify.com/show/1rGAZyubEiNLvi04fD1qna?si=342eb073f3c64175

Apple

https://podcasts.apple.com/us/podcast/legacy-under-oak/id1821997420

Money isn’t just a measure of income. It reflects decision-making, discipline, and self-trust. Investor IQ: How To Build Wealth In Any Market was created for anyone who has ever felt behind, confused, or late to the wealth conversation, offering a clear decision making framework across multiple financial areas that most people spend years learning through trial, error, and costly mistakes.

Purchase Here

Whether you are battling with negative thinking patterns, low productivity, past trauma, toxic individuals, lack of self-discipline, or anything else dragging you back, this self-help book was created for you.

Purchase Here

Amazon

Barnes & Noble

https://www.barnesandnoble.com/w/improvement-begins-with-i-courtney-s-jenkins/1143711798

In this episode of Talk with Ten, Ten sits down with Courtney S. Jenkins for an insightful conversation on finances, smart investing, and building long-term wealth. From practical money moves to real estate strategies and creating a lasting legacy, Courtney shares valuable knowledge that can help you secure your financial future.

Watch Here

The Four Pillars of Legacy Under Oak Co.

Mindset

Transform how you think about wealth. Shift limiting beliefs, strengthen your financial mindset, and design a long-term legacy that reflects your goals.

Wealth Foundation

Build confidence with money through personalized strategies for budgeting, saving, debt management, and credit improvement.

Investments

Make your money work for you through strategic investing and income growth designed to build long-term financial freedom.

Business

Scale your business with intention using proven strategies that maximize profits, optimize systems, and support sustainable growth.

PRIVATE CONSULTATION REQUEST

If you’re ready to elevate your financial life with purpose and precision request a private consultation to start.

CLIENT SERVICE TIMELINE

How we work together to build your financial legacy.

Phase 1: Discovery

Initial assessment of goals, current finances, and mindset. Clarify vision, values, and outcomes to ensure alignment.

Phase 2: Strategy & Planning

Develop a personalized financial framework (budgeting, investing, business strategy). Introduce mindset practices for disciplined decision-making.

Phase 3: Implementation

Guide clients through actionable steps — investments, business growth, wealth systems. Provide accountability, feedback, and adjustments.

Phase 4: Growth

Fine-tune strategies, scale operations or investments, and optimize wealth systems. Build long term financial confidence, independence, and strategic decision making.

THE LEGACY FRAMEWORK

The Legacy Framework combines mindset, strategy, and action to ensure every decision you make today maximizes your financial power and growth.

Engagement Standards

Scope of Services

Legacy Under Oak Co. provides financial coaching, strategy, and educational guidance designed to empower high-achieving individuals. We do not provide direct investment management, tax preparation, or legal services. Our focus is on helping you make intentional financial decisions and build a framework for sustainable wealth.

Client Responsibility

You are ultimately in control of your financial decisions. Our guidance is designed to inform, structure, and elevate your approach, but outcomes depend on your actions. Legacy Under Oak Co. does not guarantee results, and all financial responsibility rests with the client.

Right to Decline

We achieve the best results with clients who are fully aligned, committed, and ready to engage with our process. If it appears that we are not the right fit, we may respectfully decline or refer you to a more suitable resource.

PROOF IN THE PROCESS

Loved working with Courtney. She is a multi talented individual that teaches you with no fluff how to exactly achieve not only your financial goals but your investment goals.

One of the best if you're willing to put in the work. I've come across many financial coaches that lacked direction and communication. Not only did Courtney get my investment portfolios together but the value, motivation, and education she gives is amazing. Highly recommend her whenever I speak about my finances.

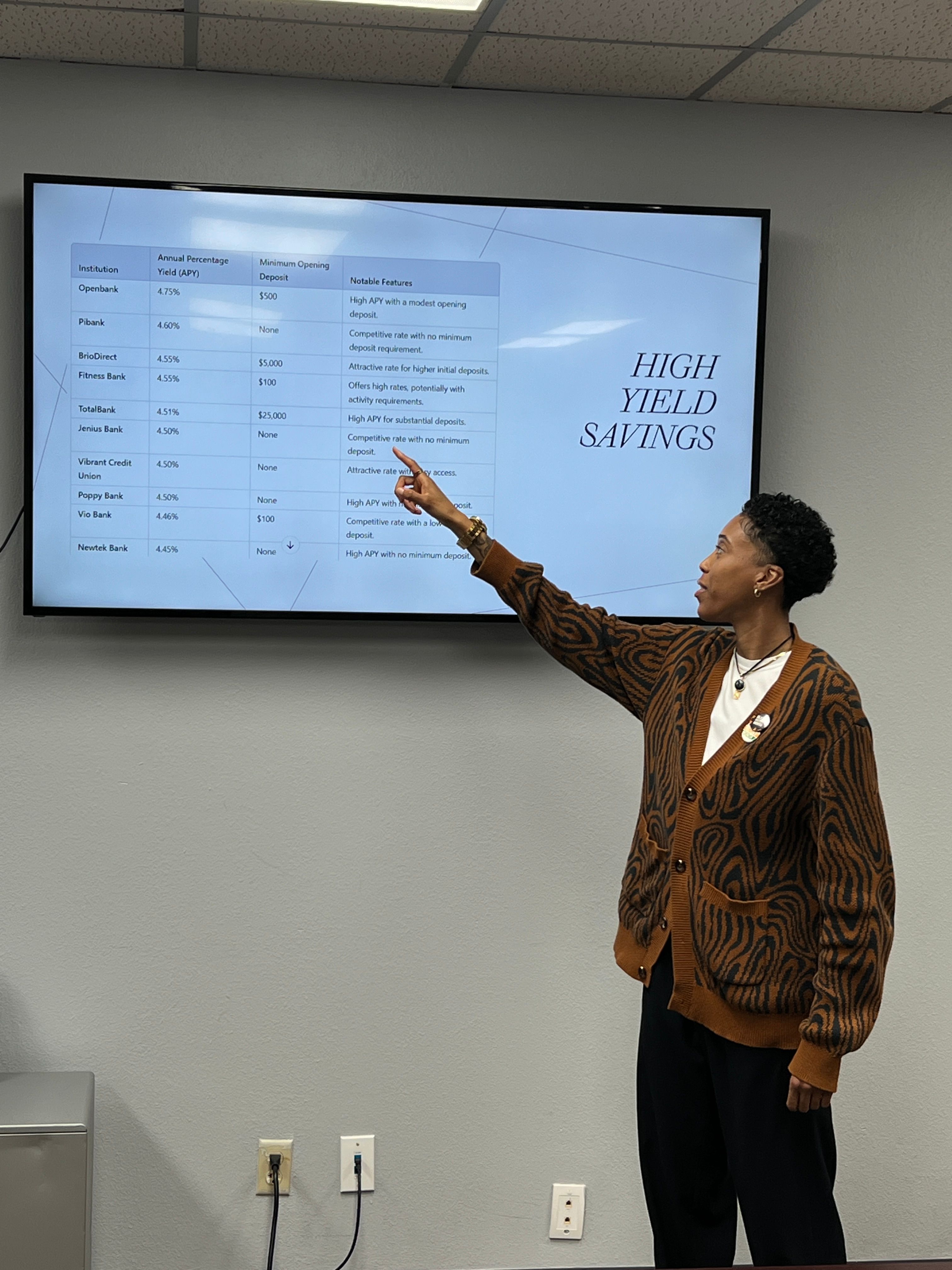

Before Courtney, I had money but no structure. Within 2 months, I now have a clear investment plan for my stocks and automated savings for my high yield account.

Courtney helped me set new financial goals, provided me with resourceful information to fix my credit score. I wish I met her before making some financial bad decisions. I strongly recommend this focused woman, for financial education, clear mindset and more.

If you are looking for a coach, look no further. You won't find the same knowledge and compassion anywhere else. Thank you for changing my life.

Let me just start by saying my mindset and life changed after I read “Improvement begins with I” written by Courtney J. She’s an amazing life coach, motivator and entrepreneur. Also she helped me get my loan interest down 0.25% by signing up for auto pay. Sign up for her Financial course you don’t want to miss out on this knowledge and experience.

Amazing experience. Highly recommended!

I happened to meet Courtney one day and she invited me to her book signing (which was amazing). I purchased a copy of her book “Improvement Begins With I” and IMMEDIATELY began highlighting the messages I knew I was meant to see. Great personality and a book full of gems.

Inspirational. Thank you so much. This is just what I needed.

FEATURED FOR EXPERTISE

Showcasing appearances and features in prominent publications across finance, business, and personal development.

FAQs

Individuals who:

Are serious about investing, scaling their business, or building strategic wealth.

Understand the importance of mindset, discipline, and long-term planning.

Want guidance that is personalized, results-driven, and actionable.

Traditional advisors often manage your money for you, but my approach is different. I work with you to build strategy, strengthen your mindset, and create systems that empower you to make confident, intentional financial decisions.

Absolutely! I work with clients at all levels whether you’re creating a budget, building savings, deciding on investments, scaling a business, I tailor strategies to your current stage.

Start by completing a brief inquiry so I can understand your goals, current situation, and vision.

Investing isn’t about how much you start with, it’s about starting strategically and building over time.

Yes, I provide both virtual and in-person sessions depending on client needs and location.

I accept credit cards and bank transfers. Payment ensures your place and allows us to start strategically growing your wealth.